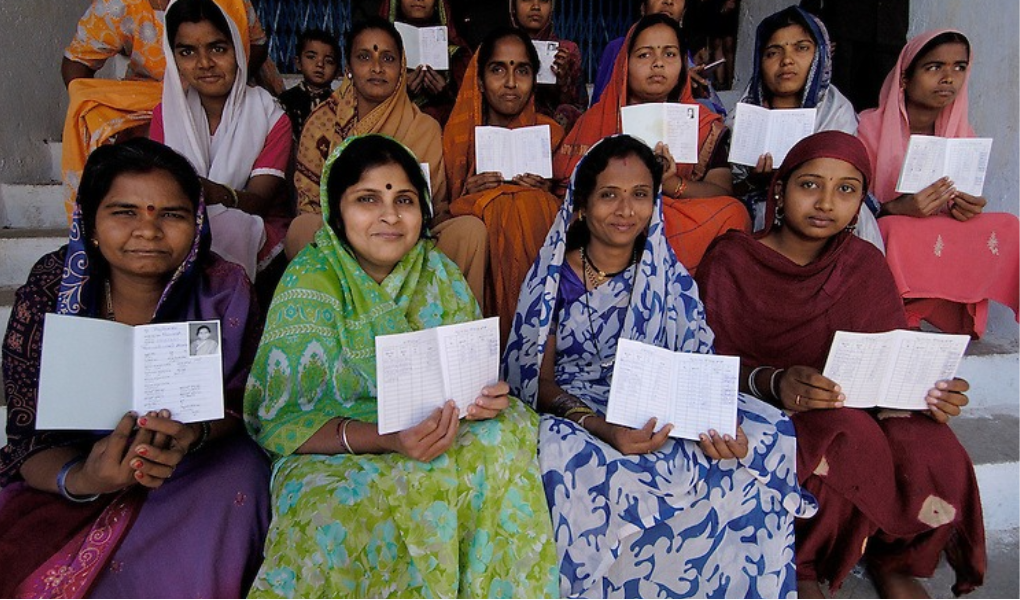

Empowering Women, Transforming Lives: Together, We Rise! Welcome To

Srinidhi Mutually Aided Co-operative Thrift and Credit Society Ltd

Who We Are!!

We Completed 100+ Projects World Wide

Established in 2015 under the Andhra Pradesh Mutually Aided Cooperative Societies Act, 1995, Srinidhi Mutually Aided Co-operative Thrift and Credit Society Ltd (Registration No. AMC/MNR/DCO/2015/3204) is committed to uplifting communities by empowering women and enhancing their financial independence. The society was founded with a clear mission: to improve the living standards of its members by providing access to secure deposit options and timely, affordable credit.

Srinidhi thrives on principles of mutual aid, transparency, and inclusivity. It offers a range of deposit schemes and lending solutions tailored to the diverse needs of its members, ensuring financial support at every stage of life. The society is especially focused on enabling women to become financially self-reliant through access to responsible banking services.

Keeping pace with evolving financial and technological advancements, Srinidhi continuously updates its offerings to remain competitive and member-centric. Its operations are designed to foster trust, economic empowerment, and sustainable growth. By prioritizing community welfare and financial literacy, Srinidhi serves not just as a financial institution, but as a movement for social change—where each member’s growth contributes to the collective progress. Together, we rise, transforming lives through empowerment and cooperation.

Meet Our President

S.Nagalaxmi

President’s Message (MISSION)

Our Sri Nidhi Mahila Podupu Sangam aims to uplift and empower women by providing them with self-employment opportunities through group activities like thrift and credit. Our mission is to ensure the financial stability of women by supporting their economic growth and fostering self-reliance through sustainable development initiatives.

Vision

Our vision is to create a self-reliant and empowered society where women are economically independent and socially strong. We aim to achieve this by offering skill development, financial literacy, and entrepreneurial support, thereby improving their quality of life and economic status.

About the Society

The MACS (Mutually Aided Cooperative Society) is a women-driven cooperative formed to promote savings, credit, and sustainable financial practices among its members. Our society focuses on empowering women by providing them with financial assistance, training, and support to achieve their goals.

Key Focus Areas of the Society

The society works on various fronts to enhance the financial stability and overall well-being of women, including:

Financial literacy and self-employment training

Health awareness and medical support

Livelihood support through group businesses

Financial aid for education and skill development

Through the guidance of our leaders and the active participation of our members, we strive to create a financially stable and self-reliant community of women.

What We Do?

At Srinidhi Mutually Aided Co-operative Thrift and Credit Society Ltd, we provide secure and flexible deposit options and offer timely, affordable credit to meet the financial needs of our members, especially women. Established in 2015, we operate under cooperative principles to promote financial independence, improve living standards, and support community development. We focus on empowering our members through responsible financial services and by embracing the latest financial and technological innovations. By ensuring easy access to savings and credit, we help individuals build a stable future and work collectively toward economic and social progress. Together, we grow, support, and uplift lives.

Our Products

At Srinidhi Mutually Aided Co-operative Thrift and Credit Society Ltd, we offer a wide range of member-focused financial and support services designed to promote financial stability, growth, and security:

Savings Bank Account (SB A/C)

Members can open a savings account by providing valid identity and address proof. It offers convenient deposits and withdrawals along with interest on savings. Features

- Easy deposis and withdrawals

- Interest on deposits

- Accessible across all branches

Recurring Deposit (RD) Scheme

A disciplined savings option where members deposit a fixed amount monthly and receive a lump sum at maturity.

Features:

- Education

- Tax Saving

- Future Planning

Lakhapati Fixed Deposit (FD)

A cumulative fixed deposit with a minimum tenure of 2 years.

Features:

- No premature closure within 1 year

- Pre-closure after 1 year with 2% penalty

- Loan up to 50% of FD amount

Monthly Income FD Scheme

Provides monthly interest payout for regular income.

Features:

- ₹1,000 per month per ₹1 lakh deposit

- No pre-closure within 1 year

- Pre-closure after 1 year with 2% penalty

- Loan up to 50% of FD amount

Passbook and Account Statement

All members are provided with passbooks and/or account statements to track transactions and maintain transparency.

Accident Insurance and General Insurance

Accident Insurance Covers members in the event of accidental death or permanent disability. Ensures financial protection for families.

Genertal Insurance Provides coverage against risks such as illness, property damage, and other personal or business-related losses.

Mobile Banking (SRINIDHI App)

Access account details, balances, and statements on the go through the SRINIDHI mobile banking application.

Benefits:

- Secure and user-friendly

- Real-time account updates

Microfinance

The Society offers Microfinance Loans to support low-income individuals, self-help groups, and small entrepreneurs.

Features:

- Small ticket loans for income-generating activities

- Easy repayment options

Loan Against FD

Members can borrow against their fixed deposits.

Loan Options:

- Up to 50% on regular FDs

Up to 80% on special Lakhpat FDs

Interest Rate: As per Society norms

Our Corporate Social Responsibilities

Promoting Education

We recognize that education is the key to breaking the cycle of poverty and building a better future. To support this:

We sponsor the education of 10 boys and girls from economically disadvantaged backgrounds.

This initiative aims to provide equal opportunities for underprivileged children to access quality education and achieve their full potential.

Supporting Cleanliness and Public Health

In alignment with the Swachh Bharat Abhiyan (Clean India Campaign), we are committed to promoting hygiene and cleanliness in our communities:

We plan to install waste collection bins in strategic locations around our operational areas.

This step contributes to maintaining a cleaner, healthier environment and raises awareness about proper waste disposal.

Our Recent Programs